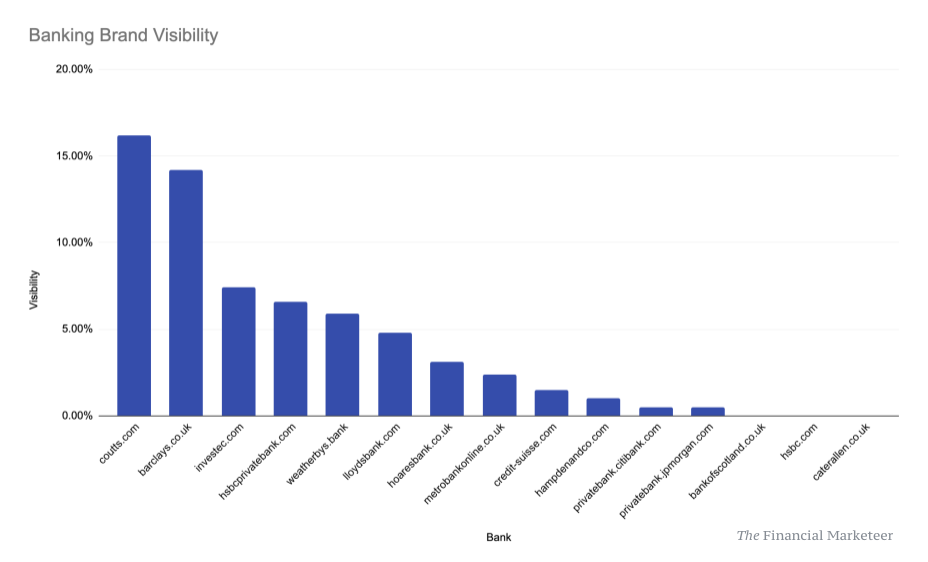

In our first analysis of the online visibility race in the wealth & private banking sector, there’s one clear winner.

Coutts claims first place, delivering online search visibility of 16.2%.

Coutts’ closest rival is Barclays with 14.2% share of online search.

The analysis is based on a review of 96 search terms relevant to audiences seeking wealth management and private banking services. All of the data comes from Google search in the UK based on desktop search results.

Here is the full break down, accurate on 10/04/2020:

| Bank | Visibility |

| coutts.com | 16.20% |

| barclays.co.uk | 14.20% |

| investec.com | 7.40% |

| hsbcprivatebank.com | 6.60% |

| weatherbys.bank | 5.90% |

| lloydsbank.com | 4.80% |

| hoaresbank.co.uk | 3.10% |

| metrobankonline.co.uk | 2.40% |

| credit-suisse.com | 1.50% |

| hampdenandco.com | 1.00% |

| privatebank.citibank.com | 0.50% |

| privatebank.jpmorgan.com | 0.50% |

| bankofscotland.co.uk | 0.00% |

| hsbc.com | 0.00% |

| caterallen.co.uk | 0.00% |

Explaining the results

15 banking brands were reviewed in total, chosen because they were the most ‘visible’ banks when carrying out initial sample searches.

Visibility is a score which represents a brand’s share of search, the higher the percentage, the more likely the brand is to appear in a web search results page.

Further analysis

Three of the domains analysed failed to register significant enough share to show any percentage reading: Cater Allen, HSBC and Bank of Scotland. It’s worth noting, however, that HSBC does make an appearance further up the list under its private banking domain; hsbcprivatebank.com which registers a score of 6.6%.

The results suggest that, at present, Coutts and Barclays have a clear lead with none of the other brands succeeding in achieving double-figures.